Михаил Зборовский: Как алгоритмы ИИ трансформируют iGaming

avril 7, 2023Alcohol withdrawal timeline: day by day, what to expect in each stage of detox

décembre 4, 2023Revolut provides a complete and handy cell banking experience, especially for these who require UK checking account services. With features like open banking, financial savings vaults, rewards, investments, and journey perks, Revolut offers a range of advantages for its users. Bunq offers a modern and revolutionary banking expertise by way of its cellular app. With features https://execdubai.com/ like a quantity of financial institution accounts, a budgeting device, cashback rewards, and a CO2-free program, Bunq offers a variety of advantages to its users. Having a local UK checking account facilitates simpler day-to-day transactions, eliminates expensive international banking charges, and helps streamline managing your funds.

In this section, we’re going to have a look at the necessities for opening a UK bank account as a non-resident. We may also share some info on opening accounts for non-resident UK LLPs and UK LTDs. As is the case in lots of countries, banks do not usually proceed with potential shoppers from blacklisted countries except they look like extremely profitable. In different words, in case you are prepared to make a big deposit, invest in bank merchandise and options, or generate revenue for the financial institution by way of charges. In most circumstances, these accounts are domiciled in nations just like the Isle of Man, Jersey, Guernsey, Dubai, Singapore, Hong Kong, and elsewhere.

What Data Is Needed To Register A Company?

This kind of firm is often registered by non-profit organisations such as clubs and charities. This is by far the most popular type of firm registered within the UK and is commonly generally known as a restricted company. It is ready up for the aim of creating a profit, and has the added benefit of limited legal responsibility safety of non-public assets. Simply select a company name, select a bundle, checkout and pay, and complete a short form together with your firm details. Speedy Formations is a Companies House-approved company formation agent with over 10 years of expertise. We can register firms for patrons who’re residents of most international locations.

Prestigious Tackle

We’ll additionally show you a wise alternative to a bank account https://udcs.mx/how-to-ship-wire-transfers-in-online-banking-or from money providers provider Clever – the Sensible account, which lets you manage your cash in 40+ currencies in Germany, the UK and worldwide. It is really helpful to check with the financial institution instantly to verify the client support companies obtainable for your business bank account. To get hold of the current trade rates, you probably can check the bank’s web site, contact its customer service middle, or use its online banking platform. This consists of the money companies provider Wise, which has a multi-currency account, international debit card, transfer services and app out there to make use of in Switzerland. You can also try non-bank alternatives, which don’t have a banking licence however supply companies similar to accounts, payments and cards.

Barclays Worldwide

- Confirm particulars with the supplier you’re thinking about before making a decision.

- As Starling solely presents its GBP enterprise account freed from cost (it additionally has EUR and USD for a fee), I’m at present utilizing the Sensible business account to deal with my EUR and USD transactions.

- Enterprise financial institution accounts fulfill essential spending and transaction requirements for non-residents and may also provide billing, accounting, and tax assistance companies.

- Nevertheless, the method may be very difficult to navigate should you do not have specific documentation and cannot go to a bank in particular person.

- HSBC is one of the largest banks within the UK and a serious global brand within the UK and all over the world.

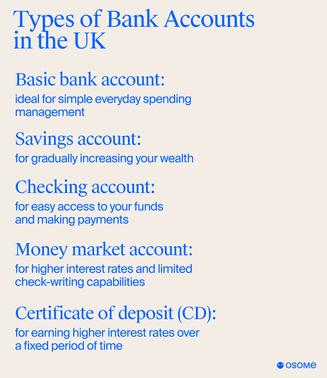

One of the main challenges non-residents face is providing proof of handle. Conventional banks retain the discretion to refuse account opening, so understanding the basics of the UK banking system is crucial. One approach to overcome this problem is by offering a financial institution assertion from another bank as address verification. Digital bank-like accounts are typically very person friendly and have nice Apps which make it straightforward to be paid and pay others. Actual banks then again are probably to have additional charges however in addition they pay curiosity and have more services like bank cards, loans and a deposit assure. Revolut (founded in 2015) has a EU banking license and presents fully digital checking and financial savings accounts.

In practice though, digital bank-like companies can do many issues actual banks do and at least one offers a way to get paid and pay others they usually don’t require proof of a UK handle. We suppose, in case you are a non-resident the simplest way to uk bank account opening services open an account is through an online bank-like service (not a real bank). For our cash, Clever is the finest choice if you are still overseas due to their capability to get paid like a neighborhood (in the UK) before you even arrive. Revolut then again requires to native phone number, however has nice app primarily based service and card which may be tremendous helpful for travellers.

The bank may must contact you for additional info or clarification. Whether you’re seeking to open a conventional or business Setting Up a Dubai Bank Account bank account or explore alternatives corresponding to digital banking, choices are available. Bear In Mind, the key to a successful banking experience in the UK is understanding your needs, doing your research, and making informed selections. With this information, you’re nicely in your way to monetary stability in your new home. With the advent of the digital period, the flexibility to open a bank account remotely has emerged as a helpful alternative. Non-residents can open a checking account on-line with conventional banks accepting them as clients.

There are not any set-up or monthly fees; you solely pay when you convert or ship cash. That makes the World Account not just a substitute for a UK bank account, but typically a quicker, cheaper and more versatile option for international businesses. With the best enterprise checking account, non-Singapore residents can take pleasure in simple and secure access to banking services and efficiently handle their enterprise finances. To additional improve the security of business financial institution accounts, banks might offer extra features such as token-based authentication, transaction alerts, and biometric authentication. These options may help to stop unauthorized entry and detect fraudulent actions.